AI Summit: Exploring Innovations and Future Trends in Artificial Intelligence

AI Summit: Shaping the Future of Technology

The AI Summit is a premier event that brings together industry leaders, innovators, and enthusiasts from around the world to explore the latest advancements in artificial intelligence. This annual gathering serves as a platform for discussing groundbreaking technologies, sharing insights, and fostering collaborations that drive the future of AI.

What to Expect at the AI Summit

The AI Summit offers a diverse range of activities designed to engage participants and provide valuable learning experiences. Some key features include:

- Keynote Speeches: Hear from thought leaders and pioneers in AI as they share their visions and insights on how AI is transforming industries.

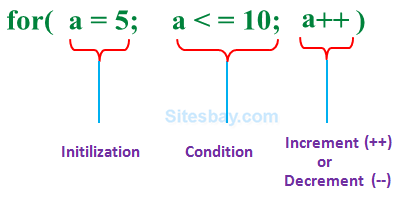

- Panel Discussions: Engage with experts on various topics such as ethical AI, machine learning advancements, and the impact of AI on society.

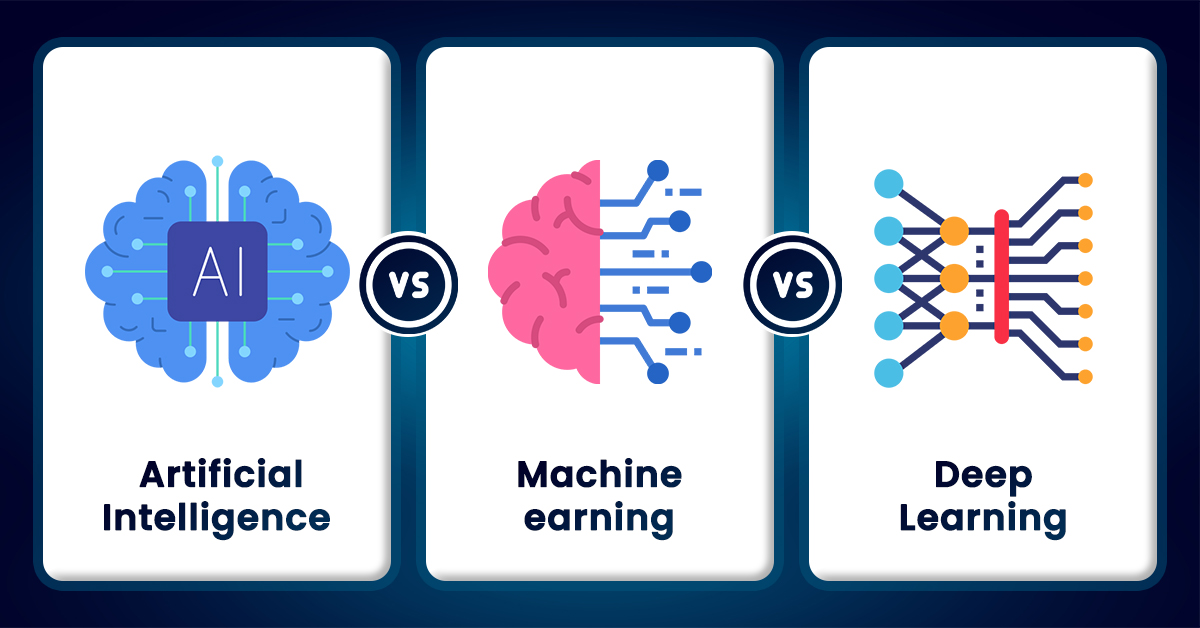

- Workshops: Participate in hands-on sessions led by industry professionals to gain practical skills and knowledge in AI technologies.

- Exhibitions: Explore cutting-edge products and solutions from leading companies showcasing their innovations in AI.

The Importance of Networking

The AI Summit provides an unparalleled opportunity for networking with industry peers, researchers, and potential collaborators. Attendees can connect with like-minded individuals who are passionate about harnessing the power of AI for positive change. These connections often lead to fruitful partnerships and new business opportunities.

Tackling Challenges in Artificial Intelligence

A significant focus of the summit is addressing the challenges associated with artificial intelligence. Topics such as data privacy, algorithmic bias, and regulatory frameworks are discussed extensively. By bringing these issues to light, participants work together to develop solutions that ensure AI technologies are implemented responsibly and ethically.

The Future of AI

The discussions at the AI Summit often set the stage for future trends in artificial intelligence. As technology continues to evolve rapidly, attendees gain insights into emerging areas such as quantum computing, autonomous systems, and human-AI collaboration. These forward-looking conversations help shape strategies that organizations can adopt to stay ahead in a competitive landscape.

Conclusion

The AI Summit is more than just an event; it is a catalyst for innovation and progress in artificial intelligence. By bringing together diverse voices from across industries, it plays a crucial role in shaping how we understand and leverage this transformative technology. Whether you are an industry veteran or new to the field of AI, attending this summit offers invaluable opportunities for learning, networking, and contributing to the future of technology.

Maximize Your AI Summit Experience: 8 Essential Tips for Success

- Plan your schedule in advance to ensure you don’t miss any important sessions.

- Take notes during the presentations to remember key points and insights.

- Engage with speakers and other attendees to network and exchange ideas.

- Visit exhibitor booths to learn about the latest AI technologies and solutions.

- Stay hydrated and take short breaks to stay focused and energized throughout the summit.

- Ask questions during Q&A sessions to clarify any doubts or seek further information.

- Follow up with contacts made during the summit to continue discussions or collaborations.

- Share your own experiences and knowledge during panel discussions or networking events.

Plan your schedule in advance to ensure you don’t miss any important sessions.

Attending an AI Summit can be an overwhelming experience due to the sheer number of sessions, workshops, and networking opportunities available. To make the most of your time, it’s crucial to plan your schedule in advance. Review the agenda before the event and identify key sessions that align with your interests and professional goals. Prioritize these must-attend events to ensure you don’t miss out on valuable insights from industry leaders and experts. Additionally, allow some flexibility in your schedule for spontaneous meetings or events that may arise. By organizing your itinerary ahead of time, you can maximize your learning experience and make meaningful connections without feeling rushed or missing important content.

Take notes during the presentations to remember key points and insights.

Attending an AI Summit can be an overwhelming experience with a wealth of information being shared in a short period. To maximize the benefits of the summit, it’s crucial to take notes during the presentations. By jotting down key points and insights, you ensure that you capture valuable information that can be referenced later. This practice not only aids in retaining important concepts but also allows you to reflect on the discussions and apply what you’ve learned to your own projects or business strategies. Additionally, having detailed notes makes it easier to share knowledge with colleagues who couldn’t attend, expanding the impact of the summit beyond just those present.

Engage with speakers and other attendees to network and exchange ideas.

Engaging with speakers and other attendees at an AI Summit is a crucial aspect of maximizing the event’s benefits. By actively participating in discussions, asking questions, and sharing insights, you create opportunities to network with industry leaders and fellow enthusiasts. These interactions can lead to valuable exchanges of ideas, fostering collaborations that may spark innovation or even future partnerships. Building these connections not only enhances your understanding of the latest AI trends but also positions you within a community of like-minded professionals who are shaping the future of technology. Whether through informal conversations or structured networking sessions, taking the initiative to engage can significantly enrich your summit experience.

Visit exhibitor booths to learn about the latest AI technologies and solutions.

Visiting exhibitor booths at an AI Summit is a fantastic opportunity to discover the latest advancements in AI technologies and solutions. These booths are often staffed by knowledgeable representatives who can provide detailed insights into cutting-edge products and services. Attendees can engage in one-on-one conversations, ask questions, and even see live demonstrations of innovative tools that are shaping the future of various industries. Whether you’re interested in AI-driven software, hardware innovations, or specific applications like machine learning or natural language processing, these exhibitor booths offer a wealth of information and inspiration. Networking with exhibitors can also lead to valuable connections and collaborations that might benefit your own projects or business endeavors.

Stay hydrated and take short breaks to stay focused and energized throughout the summit.

Attending an AI Summit can be an intense and intellectually stimulating experience, with a packed schedule of keynote speeches, panel discussions, and workshops. To make the most of it, staying hydrated and taking short breaks is essential for maintaining focus and energy levels. Drinking plenty of water helps keep the mind sharp and prevents fatigue, while brief breaks allow attendees to recharge mentally. These pauses offer a chance to process information, reflect on insights gained, and prepare for the next session. By prioritizing hydration and rest, participants can enhance their engagement and ensure they are fully present for every moment of the summit.

Ask questions during Q&A sessions to clarify any doubts or seek further information.

Attending an AI Summit presents a unique opportunity to engage directly with experts and thought leaders in the field. During Q&A sessions, it’s crucial to ask questions to clarify any doubts or seek further information on topics of interest. This not only enhances personal understanding but also enriches the discussion for everyone involved. By actively participating, attendees can gain deeper insights and potentially uncover new perspectives that may not have been addressed during the presentations. Moreover, asking questions can facilitate networking opportunities, as it demonstrates engagement and curiosity, qualities that are highly valued in collaborative environments.

Follow up with contacts made during the summit to continue discussions or collaborations.

Attending an AI Summit is an excellent opportunity to meet industry leaders and peers, but the real value often lies in the relationships that are cultivated afterward. Following up with contacts made during the summit is crucial for continuing discussions and exploring potential collaborations. Whether through a simple email, a LinkedIn connection, or scheduling a follow-up meeting, reaching out helps solidify the initial connection and demonstrates genuine interest in future engagements. This proactive approach can lead to valuable partnerships, knowledge exchange, and even new business opportunities. By maintaining these connections, participants can stay informed about industry trends and potentially collaborate on innovative projects that were sparked during the summit interactions.

Share your own experiences and knowledge during panel discussions or networking events.

Sharing your own experiences and knowledge during panel discussions or networking events at an AI summit can significantly enrich the experience for both you and other participants. By offering insights from your personal journey with AI, you contribute to a diverse exchange of ideas that can inspire innovative thinking and problem-solving. Your unique perspective may provide valuable lessons or spark new ideas among attendees, fostering a collaborative environment where everyone can learn from each other’s successes and challenges. Engaging actively in these discussions not only enhances your professional reputation but also helps build meaningful connections with industry peers who share similar interests and goals.