Navigating Software Development Costs: Insights from PwC on Effective Accounting

Accounting for software development costs is a crucial aspect for companies in the tech industry. Properly managing and reporting these costs can have a significant impact on a company’s financial statements and overall performance. PwC, a renowned professional services firm, provides valuable insights and guidance on how to account for software development costs effectively.

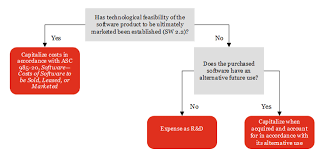

Software development costs can be classified into two main categories: research and development (R&D) costs and production or capitalization costs. R&D costs are typically expensed as incurred since they are related to activities aimed at creating new software products or improving existing ones. On the other hand, production costs that meet specific criteria, such as technological feasibility, can be capitalized and amortized over the useful life of the software.

PwC emphasizes the importance of determining the stage at which software development costs should be capitalized. Understanding the criteria for capitalization, such as the presence of a detailed project plan, technical feasibility, and future economic benefits, is essential in making informed accounting decisions.

Moreover, PwC advises companies to regularly assess and review their accounting policies for software development costs to ensure compliance with relevant accounting standards, such as ASC 350-40 (intangibles – internal-use software) and ASC 985-20 (software – cost of sales).

By following PwC’s guidance on accounting for software development costs, companies can enhance transparency in financial reporting, mitigate risks of misstatement or non-compliance with regulations, and make informed business decisions based on accurate financial information.

In conclusion, accounting for software development costs is a complex yet critical aspect of financial management for tech companies. Leveraging PwC’s expertise and best practices in this area can help organizations navigate the complexities of software development cost accounting effectively and optimize their financial performance.

7 Essential Tips for Accounting Software Development Costs

- 1. Capitalize costs directly related to developing or obtaining software for internal use.

- 2. Expense costs related to preliminary project stages and post-implementation activities.

- 3. Allocate costs between capitalized and expensed based on the development stage.

- 4. Consider costs such as employee compensation, third-party services, and software tools.

- 5. Review and update capitalization criteria regularly to ensure compliance with accounting standards.

- 6. Document the rationale behind capitalization decisions for audit trail purposes.

- 7. Consult with accounting professionals or refer to PwC guidance for complex scenarios.

1. Capitalize costs directly related to developing or obtaining software for internal use.

When following PwC’s tip to capitalize costs directly related to developing or obtaining software for internal use, companies can enhance their financial reporting accuracy and efficiency. By recognizing and capitalizing costs that meet specific criteria, such as those directly tied to software development activities with future economic benefits, organizations can better align their accounting practices with industry standards. This approach not only ensures proper allocation of expenses but also enables companies to reflect the true value of their software assets on their balance sheets, ultimately improving transparency and decision-making processes.

2. Expense costs related to preliminary project stages and post-implementation activities.

When following PwC’s tip on accounting for software development costs, it is essential to expense costs related to preliminary project stages and post-implementation activities. By recognizing and expensing these costs as they occur, companies can accurately reflect the true financial impact of software development projects in their financial statements. This approach ensures transparency and compliance with accounting standards while providing a clear picture of the overall expenses associated with software development initiatives.

3. Allocate costs between capitalized and expensed based on the development stage.

When it comes to accounting for software development costs, PwC’s tip to allocate costs between capitalized and expensed based on the development stage is crucial. By determining the specific stage of development, companies can make informed decisions on whether to capitalize or expense costs effectively. This approach ensures that expenses related to research and development activities are recognized appropriately while also identifying costs that meet the criteria for capitalization. Proper allocation based on the development stage enhances financial reporting accuracy and transparency, enabling companies to comply with accounting standards and optimize their financial performance in the software development process.

4. Consider costs such as employee compensation, third-party services, and software tools.

When accounting for software development costs, it is essential to consider various expenses, including employee compensation, third-party services, and software tools. These costs play a significant role in the overall budget of a software development project and should be carefully tracked and allocated accordingly. Employee compensation covers salaries, benefits, and other related expenses for the team members involved in the development process. Third-party services may include outsourcing certain tasks or hiring external consultants to support the project. Additionally, investments in software tools and technologies are crucial for enhancing productivity and efficiency during development. By carefully considering these costs, companies can ensure accurate financial reporting and better decision-making regarding their software development initiatives.

5. Review and update capitalization criteria regularly to ensure compliance with accounting standards.

It is essential for companies to review and update their capitalization criteria regularly to ensure compliance with accounting standards, as advised by PwC. By periodically reassessing the criteria for capitalizing software development costs, organizations can stay aligned with relevant accounting standards, such as ASC 350-40 and ASC 985-20. This proactive approach not only helps companies maintain accurate financial reporting but also reduces the risk of non-compliance and potential errors in accounting for software development costs. Keeping capitalization criteria up-to-date allows companies to make informed decisions regarding the treatment of software development expenses, ultimately contributing to transparent and reliable financial statements.

6. Document the rationale behind capitalization decisions for audit trail purposes.

To ensure transparency and accountability in accounting for software development costs, PwC recommends documenting the rationale behind capitalization decisions. By clearly outlining the reasons for choosing to capitalize certain costs, companies create a robust audit trail that can be reviewed and verified by internal and external auditors. This documentation not only enhances the credibility of financial statements but also provides valuable insights into the thought process behind capitalization choices, helping stakeholders understand the financial impact of software development activities.

7. Consult with accounting professionals or refer to PwC guidance for complex scenarios.

When facing complex scenarios related to accounting for software development costs, it is advisable to seek guidance from accounting professionals or refer to PwC’s expert advice. Consulting with experienced professionals can provide valuable insights and ensure that companies navigate intricate accounting issues effectively. By leveraging PwC’s guidance, organizations can make informed decisions, adhere to accounting standards, and optimize their financial reporting processes in the context of software development costs.